Application Chain, also known as “AppChain” or “Application Specific Blockchain”, is designed to operate specific applications instead of opening to multiple applications. Typically, Application Chain is attached to existing L1 Blockchains in order to reuse the security and gas model fully. At the same time, Application Chain is flexible to have its own consensus mechanism, throughput, technical architecture, gas fee model, and process their own transactions, etc. There are many forms of Application Chains from PoS/PoA sidechains to L2 solutions (Optimistic Rollups or ZK-Rollups).

Starting from 2020, there are a lot of pilots on different scalable solutions, e.g., Ronin for Axie Infinity, DeFi Kingdoms on Avalanche subnets, dYdX/Uniswap expanding to ZK or Optimistic Rollup solution, and FNCY chain. Ethereum EIP 4844, rollup solutions, and Application Chains are becoming a new norm and trend. We strongly believe in 2023, Application Chain or App-specific Scaling solutions will be booming to meet the challenges from Web3 massive adoption.

In this blog, we will cover:

- L1 is not scalable and flexible enough for large-scale dApps, e.g. apps with over 1M in DAU. Multi-chain, especially Application Chain, will create a paradigm shift in the blockchain ecosystem.

- Scalable solutions are more mature and validated by different L1 and dApps with large user bases, e.g., NFT/GameFi, DeFi, and Web2 Game.

- How to select the suitable solution for your business needs from having a better evaluation framework.

- NodeReal has launched Semita V2, a one-stop platform aimed at helping developers build their custom Application Chains, or scale their blockchains with layer 2 solutions, including ZK Rollup and Optimistic Rollup.

1. The History of Application Chain

“Application Chain” can be traced back to 2016, when both Cosmos and Polkadot released their whitepapers and introduced this concept. But it was not until the network (IBC and ParaChain) launched in early 2021 that Cosmos and Polkadot fully implemented “Application Chain”.

At the same time, due to the exponential user growth, computing-focused blockchains like Ethereum started facing serious scalability and high gas fees. This resulted in a great many alternatives. For example, Polygon, zkSync(1.0), StarkWare, Arbitrum, Optimism, and BSC came to the stage from 2019 to 2021.

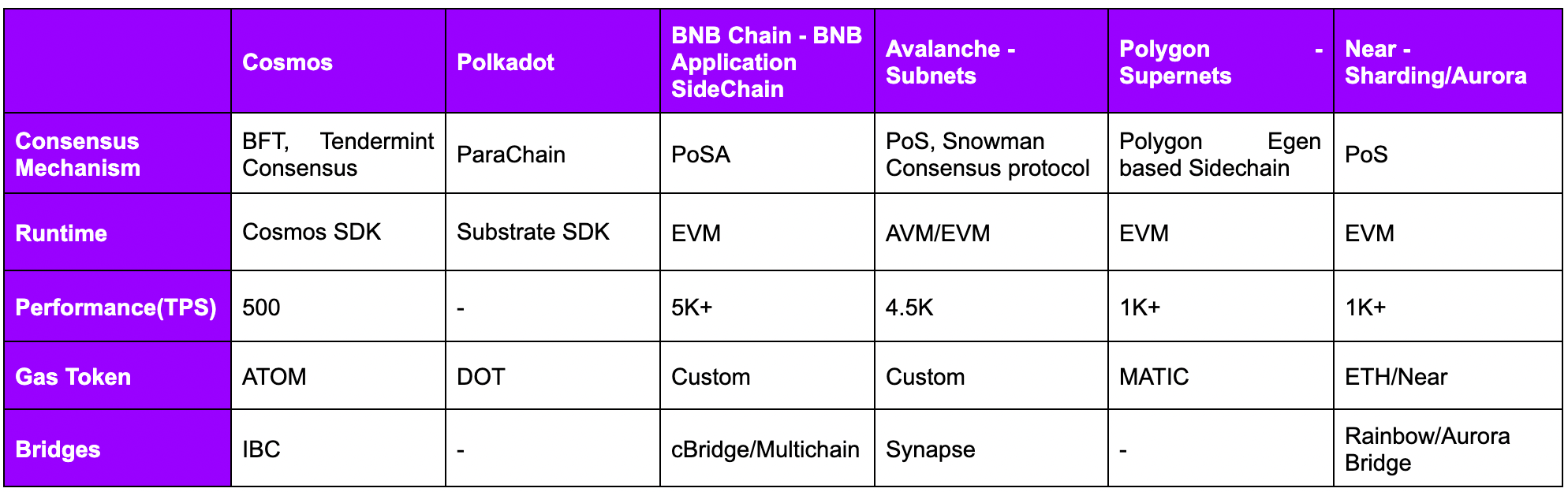

Currently, there are various platforms already unlocking the Application Chain infrastructure, as follows:

Table 1: Application Chain Solution

2. Benefits and Tradeoffs of Application Chain

Application Chain emerged as an ideal solution to handle performance issues, and meet various specific requirements from ecosystems, applications, and developers. Moreover, Application Chain can help with value capture and customised gas models. Here are some brief explanations of the benefits and risks when applying an Application Chain (Best References [1] [2] [9]):

Why Application Chain?

High performance

Some of the projects such as order book protocols, and GameFi may have higher requirements for performance, whilst competing with others for more resources in a shared blockchain environment. In this scenario, there are several key barriers:

- Latency of transactions

- High transaction fees

- Uneven distribution of resources

Application Chain is designed for high performance. As shown in table 1, the average TPS for these Application Chains surpasses 1K+, which means Application Chains offer the ability for projects to remain high throughput and low latency with dedicated resources.

Customizability

Applications have more flexibility to customise their own chains, including their own tokenomics, special gas model, governance model, etc.

Most of the large-scale GameFi projects or order book exchanges will require super high throughput to optimise the user experience. Additionally, GameFi projects also require gasless solutions, but usually, these scenarios can’t be met by computing-focused blockchains and have to turn to different solutions, like Application Chains.

Ecosystem requirements

Projects on Polkadot and Cosmos are essentially required to build their applications on Application Chain.

In Polkadot’s ecosystem, different Application Chains have different focuses: PolkaDEX for high-performance order book DEX, Phala for privacy, and Nodle for IoT Networks.

Similar to Polkadot, the Cosmos ecosystem also has different chains that implement an execution engine including EVMOS (EVM compatible) and Juno (CosmWasm smart contracts). On top of general-purpose chains, there are several specific applications: Osmosis for AMM DEX, Mars Hub for Lending, and Secret for privacy.

Value Add - Better Tokenomics

There are two kinds of fees users pay when interacting with applications on a monolithic blockchain: gas fees and native application fees.

Native application fees are essential for the application’s revenue stream, such as platform trading fees or spreads for lending protocols. This can help applications to capture more value to incentive communities and increase the adoption of applications. On the contrary, gas fees can not add any value to both applications and users. For DeFi protocols, such as dYdX, MEV leakage should also be integrated into their economic ecosystem. This level of specialisation aligns the value of applications and underlying layer(s) (execution, settlement, consensus) under a unified application token, and rewards the participants more.

Extra Features

For traditional Web2 institutions, fully permissionless is required from day one like KYC’d validators. And privacy-focused applications, such as privacy payments or trading may require ZK proof as a basis. All these scenarios can not be met through a general-purpose computing blockchain.

Why Not an Application Chain?

As coins have two sides, there is a trade-off between benefits and risks when implementing an Application Chain. The majority of tradeoffs are about complexity, security risks, composability, cost, etc.

Security Risks

In Application Chains, the security or the valuation highly relies on the success of one application. Considering the nature of Application Chains, they can be implemented with L2 sequencers or independent PoS validators, in both cases, the price of the native token will control validators’ rewards. An edge case should be taken into consideration when the value of the native token drops to 0, the Application Chain will crash as well. Despite this edge case, bridging risk is another issue that will degrade the user experience and increase the risk of assets.

High Costs and Waste of Resources

Generally, implementing Application Chains will require a large team, various resources, and infrastructures that startups may not be able to afford. A long list of must-have infrastructures has to be built and operated, such as RPC Node service, validators, bridges, and data analytics platforms including blockchain explorer and data indexing. Despite these needed infrastructures, high costs will be from the dev operation team, such as monitoring the network and validators and deploying all the developer environments.

Limited Composability and Atomicity

Atomic composability is one of the benefits of smart contract applications because applications can depend on each other and interact with different protocols seamlessly. In computing-focused blockchains, DEX routers can route single swap transactions into different AMMs for the best pricing. However, Application Chains lack this ability, because they add a degree of isolation to infrastructure and users within other ecosystems.

Liquidity Issues and Flexibility

Liquidity of assets in Application Chains will rely on bridges to connect with other layers or chains to get enough liquidity. It will add another layer for end-users to interact with Application Chains. Also, Application Chains lack some flexibility requiring some basic tools: blockchain explorer, RPC providers, Indexer, and Oracles, which are heavy but indispensable.

3. Choose the Best Suitable Solutions

As L1 is not scalable enough for large-scale dApps, Application Chain will be the best-suited solution for those protocols with

- 1M+ users

- Specific performance benefits from dedicated blockchain space

- Less reliance on security and atomicity, such as P2E games, Game Studios, and NFT collectibles.

The majority of the DeFi legos will still deploy on L1 Blockchains, considering the security, liquidity, and atomicity items. But for non-DeFi applications, have more options to deploy on generalised L2s or application chains according to the size of their ecosystem and requirements. Here is a rough framework to help applications select the best suitable solutions.

4. Application Chain Pilots and Opportunities

Some blockchains have provided Application Chain solutions for applications. In this section, we will cover the special scenarios for different use cases.

NFT & GameFi

- Axie Infinity launched its Ethereum sidechain, Ronin, in early 2021, and acquired millions of users quickly. Axie has high requirements for performance, such as throughput, and gas solutions.

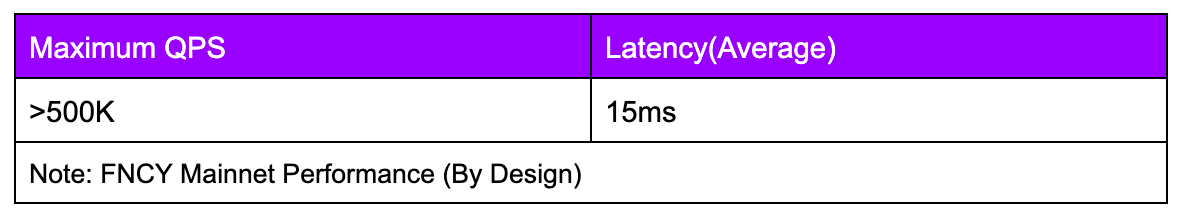

- FNCY mainnet launched on Dec 1st, 2022, which is supercharged by NodeReal’s Semita

- DeFi Kingdoms announced its move from Harmony to an Avalanche subnet in late 2021, DeFi Kingdoms Blockchain (DFK Chain)

- Yuga Labs’s efforts to spin out the Bored Ape Yacht Club (BAYC) ecosystem as a separate chain is the best use case for the value capture benefit of Application Chain. Because the BAYC community paid huge fees to the Ethereum network during the mint of the project’s NFTs assets. ~46% of the Apecoin community still voted in favor of ApeChain in mid-2022.

DeFi

- CLOB(Central Limit Order Book) exchanges are the top candidates for Application Chain in the DeFi segment. dYdX derivative protocol can process 1K order placements per second, which will require at least 1K QPS. In that case, the V3 of dYdX launched on a dedicated L2 solution based on StarkEx tech. For further scaling, dYdX announced in mid-2022 that their V4 will be built on a sovereign L1 using the Cosmos SDK.

- Osmosis - the largest DEX on Cosmos, which allows people to swap and build. Unlike most existing AMMs, Osmosis is deeply customizable and allows developers to build truly unique AMMs that can dynamically fit various outcome goals.

Game Studios & Game Engines

- Game Studios (e.g., Mythical.games) and game engines(Cocos Engine, Unity, unreal engine) are also the best matches for Application Chain. They already have a lot of experienced builders, successful games, and large user bases. so an open, customised platform will be a very suitable option here.

Web2 Giants

- Recently Polygon onboarded lots of Web2 brands into the Web3 world, including Starbucks loyalty program, Disney, Meta, Reddit, etc. All of these big giants have hundreds of millions of users. It will be naturally suitable for the Application Chain when most of their users are moving to Web3 (their daily active users will be higher than millions).

- Furthermore, a lot of traditional Web2 companies have already piloted different forms of blockchains: private blockchain or consortium blockchain in the past 10 years. However, most of these pilots are like “blockchain islands”, and they are looking for a hybrid solution to link their own blockchain and public blockchains. Application chains solution will be a more suitable solution as well.

5. Solutions from NodeReal

To meet the challenges and onboard more large-scale applications, Semita powered by NodeReal aims to help developers build their customised blockchains, or scale their blockchains with layer 2 solutions, like ZK Rollup and Optimistic Rollup.

What’s Semita and Why Semita?

Semita offers 3 types of scaling solutions to customers, including Application Chain, ZK Rollup, and Optimism Rollup. Each solution has its pros and cons, customers may choose according to their needs. With different missions, Semita will be suitable for different scenarios, such as game studios, high-frequency trading, Game Engines, DiD, and Social.

Mapping Various Modular Solutions into One Stop

Application Chains in Semita already has one successful case: the FNCY mainnet built on the BNB Application SideChain Framework. From high-performance RPC services, Faucets, Bridges, white labelled explorers, and validator setup, to staking governance tools, Semita offered a suite of infrastructure for FNCY.

Source: https://nodereal.io/semita

Configurable Block Reward Distribution

The gas fee and block reward can be distributed to the system wallet and validators automatically, and the ratio of reward can be distributed to the system wallet, and it is configurable.

Built-in Governance

Allows FNCY chains to change configuration through proposal and vote.

High-Performance RPC API Service

Bridges

Network bridges or cross-chain bridges is a tool designed to solve the challenge of interoperability between blockchains. Native token, ERC20 tokens, and NFTs should be supported by the trusted bridging solution.

White-label BlockChain Explorer

Blockchain explorer is also a needed platform for data analytics. FNCYScan powered by NodeReal, it’s a dedicated blockchain explorer for FNCY chain mainnet.

Advanced Service Suite

Semita provides abundant tools with white-labelled services to help you start. For enterprises, NodeReal One Stop Services includes the following:

Semita dedicated tool suite

- Blockchain explorers

- Faucet

- Bridge

- Governance

- Validator setup

- Wallet

- NFT Marketplace

Enterprise level service

- High-performance RPC service

- Enhanced APIs

- Runtime upgrades

- SLA & Maintenance

EVM Compatible out-of-box Dev tools

6. Conclusion

As demonstrated above, Application Chain is becoming a trend, and even Web2 giants such as Google Cloud, VMware, and Eclipse already joined this innovative wave. Application Chains have both advantages and disadvantages and they are at the very beginning of adoption.

Customers should be fully aware that Application Chain is not for everyone, and applications should base on the inherent trade-offs to choose suitable scalable solutions.

Different Blockchain-as-a-Service vendors provide different solutions for large-scale customers. At NodeReal, we aim to offer various solutions to accommodate different use cases.

If you are looking for Application Chain solutions, connect with us and let NodeReal help you scale up with ease.

Reference

[1] https://medium.com/1kxnetwork/application-specific-blockchains-9a36511c832

[2] https://medium.com/alliancedao/the-appchain-universe-the-risks-and-opportunities-9a22530e2a0c

[3] https://www.alchemy.com/overviews/what-is-an-appchain

[4] https://learn.bybit.com/altcoins/cosmos-atom-2-whitepaper-explained/

[5] https://blog.cosmos.network/why-application-specific-blockchains-make-sense-32f2073bfb37

[7] https://medium.com/nascent-xyz/the-inevitability-of-unichain-bc600c92c5c4

[8] https://degensensei.substack.com/p/the-case-for-and-against-the-appchain

[9] https://members.delphidigital.io/reports/finding-a-home-for-labs

About NodeReal

NodeReal is a one-stop blockchain infrastructure and service provider that embraces the high-speed blockchain era and empowers developers by “Make your Web3 Real”. We provide scalable, reliable, and efficient blockchain solutions for everyone, aiming to support the adoption, growth, and long-term success of the Web3 ecosystem.

Join Our Community

Join our community to learn more about NodeReal and stay up to date!